Industry Consulting

Blog /Articles

February 18.2025

AP Commentary: Trump’s Retaliatory Tariffs Will Subend Decades of Trade Rules – Rugaber

Essentials:

• Trump is trying to overhaul the rules that have governed world trade for decades. The reciprocal tariffs he announced on Thursday are likely to cause chaos for businesses around the world and clash with both allies and adversaries of the United States.

• “Obviously, this disrupts the way things have been done for a long time,” Mojica said. Trump has put all of this behind him…… It is clear that this is disrupting trade. Adjustments will have to be made on all fronts. ”

• “The trade deficit is actually a macroeconomic imbalance,” Clausing said. It stems from a lack of willingness to save and a willingness to tax. Unless these issues are addressed, we will continue to have trade imbalances. ”

February 18.2025

Reuters analysis: This rally in Chinese tech stocks is once again driven by hot money

Essentials:

• China’s (CN) breakthrough in artificial intelligence (AI) and the détente in relations with tech giants drove Hong Kong’s stock market and internet giants’ share prices sharply higher. However, the conviction of the buyers who drove the share price up was not strong.

• “As with the Hong Kong and Chinese mainland markets over the past two years or so, this is largely retail driven (and volatile) – it’s a transactional market,” Wong said. ”

• Morgan Stanley’s report showed that net exposure was near its highest level in a year, with buyers mostly coming from Asia and building long positions rather than covering short positions.

The China International Capital Corporation (CICC) estimates that southbound funds (i.e., mainland investors’ purchases) have accumulated to HK$26.6 billion (US$3.4 billion) since the Lunar New Year holiday in early February, comparable to the record inflows in September last year.

A Morgan Stanley report on hedge fund holdings showed net exposure near its highest level in a year, with buyers mostly from Asia building long positions rather than covering short positions.

Wai Pui Leung, head of institutional clients at UOB KayHian in Hong Kong, said: “The rally over the past two weeks has been driven by hot money. ”

Triggers for the rally include: the sudden popularity of Chinese artificial intelligence startup DeepSeek, which develops AI models at a much lower cost than its US (US) competitors; China was not subject to significant tariff increases by the United States, which relieved the market; and Xi Jinping’s meeting with technology business leaders.

Alibaba’s share price led the market, partly on the news of an artificial intelligence partnership with Apple, and partly because of the appearance of its founder Jack Ma at today’s conference.

Alibaba’s shares hit a three-year high on Monday and have risen nearly 50 percent so far this year.

Last week, Alibaba’s share trading volume in Hong Kong reached its highest level since its listing in late 2019, and the weekly trading volume of its U.S.-listed American Depositary Receipts (ADRs) also reached its highest level in two years.

Christopher Beddle, deputy director of China research at Gavekal Dragonomics, said: “[Jack Ma’s] presence is a huge sign of a change in the government’s attitude towards the tech sector. If there is one person who can be linked to the rectification of the technology industry, it is Jack Ma…… This is more or less a radical shift in policy stance from a few years ago, when officials vowed to curb the ‘disorderly’ expansion of capital. ”

February 11.2025

Chinese people cheer for DeepSeek as a major victory in breaking through US strict restrictions

Key points:

• As the shock waves triggered by the DeepSeek low-cost artificial intelligence (AI) model spread around the world, many Chinese viewed the local startup as a major breakthrough with the potential to rewrite history.

• Long before the global market fluctuated on Monday due to the achievements of DeepSeek, in China (CN), hot discussions about what Mark Anderson calls the “Sputnik moment in the field of artificial intelligence” began to heat up .

• Hot discussions about DeepSeek have triggered a nearly trillion-dollar plunge in U.S.-European technology stocks as investors question spending plans for some large U.S. companies.

As shockwaves from DeepSeek’s low-cost artificial intelligence (AI) model ripple around the world, many Chinese see the homegrown startup as a major breakthrough with the potential to change history, if not less than a national-level victory.

Even before the global market was shaken by DeepSeek’s achievements on Monday, buzz was heating up in China (CN) about what tech celebrities like Mark Anderson called the “Sputnik moment in artificial intelligence.”

Feng Ji, co-founder of Game Science, wrote on the social media platform Weibo: “DeepSeek could be a technological achievement that could change the fate of a country. At the same time, Feng Ji, who is also the producer of the popular game “Black Myth: Wukong”, also said: “I am so lucky! So happy! Such an astonishing breakthrough came from a purely Chinese company. ”

DeepSeek’s new open-source AI model is on par with or better than those developed by leading U.S. (US) developers, upending many assumptions within Silicon Valley about the economics of building AI and how far the U.S. is ahead of Chinese competitors in this space.

The hype over DeepSeek sparked a nearly trillion-dollar plunge in U.S. and European tech stocks as investors questioned the spending plans of some of the largest U.S. companies.

For China, the technology marks a major leap forward in its efforts to break through U.S. restrictions on chips and key components of artificial intelligence, despite challenges that Beijing still faces, such as its technology leaders Huawei Technologies Co. Ltd. and Semiconductor Manufacturing International Semiconductor Manufacturing Co., Ltd., which are believed to be several generations behind industry-leading TSMC.

The cheers for DeepSeek are the culmination of a series of technological achievements in recent years that have boosted the confidence and pride of the Chinese people in homegrown talent. Recent breakthroughs include Huawei’s Mate 60 Pro phone using China’s advanced chips, and the social media platform Xiaohongshu.

Hu Xijin, former editor-in-chief of China’s state-run Global Times, praised DeepSeek as “the first Chinese start-up to have such a profound impact on the expectations of the entire industry.”

Mr. Hu said in a post on Weibo on Tuesday that the company had “shaken the myth of America’s invincibility in the high-tech sector” and put an “explosive question mark” on the U.S. model of investing heavily in technology.

For some Chinese, DeepSeek’s success in breaking through the limits is significant — especially now under the scrutiny of US President Donald Trump after months of pressure from the Joe Bide administration.

“The plunge in the U.S. stock market shows that U.S. efforts to contain technology, including the Biden administration, and ban Nvidia from exporting advanced chips to China, have failed completely,” one Weibo user wrote on Tuesday. Not only did they fail, but they hurt themselves more than they hurt others. ”

Given the restrictions on the use of foreign AI tools and software by Chinese mainland citizens, DeepSeek is for many people who have been exposed to such advanced AI consulting services for the first time.

Some internet users who shared their experiences with the DeepSeek AI model were amazed by its ability to quickly generate complex articles and stories based on instructions. Others claim to be their personal counsellor or close friend, ready to offer helpful advice.

But in China, one of DeepSeek’s answers was particularly popular, showing that its model is not unassuming.

In explaining why Nvidia’s stock price plummeted, the AI model cited six factors, including interest rate expectations, the U.S. chipmaker’s high valuation, and competition in the industry. Weibo users, including Hu Xijin, posted an answer that said, “These factors combined to cause the collapse of Nvidia’s stock price and have nothing to do with DeepSeek.” ”

January 31.2025

World’s major currency authorities respond to Trump’s call for a rate cut – – All interest rate cuts outside the United States

Key points:

• Trump’s desire to see a drop in global interest rates be realized, except for the United States (US). The strong economy and policy uncertainty have caused differences in the policy direction of the Federal Reserve and other central banks.

• The European Central Bank cut interest rates on Thursday, the Bank of Canada (BoC) also cut interest rates on Wednesday, and the Bank of England (BoE) may follow up next week. These moves could boost the dollar as the Fed keeps interest rates unchanged.

• Currently, the Fed is unique. While central bank policymakers expect interest rate cuts later this year if inflation eases as expected, Jerome Powell said there is no reason to rush to take the next move.

US President Donald Trump’s wish for a global interest rate drop is coming true, with the exception of the United States (US). The strength of the U.S. economy, coupled with uncertainty about its own policies, has left the Federal Reserve (Fed) divergent from other central banks.

The European Central Bank (ECB) cut interest rates on Thursday, the Bank of Canada (BoC) also cut rates on Wednesday, and the Bank of England (BoE) is likely to follow suit next week. With the Fed keeping interest rates unchanged, these moves could boost the dollar, making imports cheaper and U.S. exports more expensive, further disrupting Trump’s trade agenda.

European Central Bank President Christine Lagarde noted on Thursday that a new round of trade tensions could even put more pressure on the lagging euro area, which could be a potential reason for the G20 to cut interest rates further.

Lagarde said of Trump’s threat of tariffs on a number of countries: “Growth risks remain skewed to the downside. The only thing we know for sure is that this will have a negative impact on the global scale. ”

Speaking about European interest rates, Lagarde said after the ECB’s Governing Council cut the main policy rate by another 25 basis points: “We know the direction of interest rates” will be to the downside. “At what speed, sequencing and magnitude we adjust will depend on the data we collect.”

Bank of Canada Governor Tiff McCollum also expressed displeasure with Trump’s tariff threat on Wednesday when he cut interest rates for the sixth time in a row and lowered growth forecasts for America’s neighbors. “A protracted and widespread trade conflict would severely damage Canada’s economic activity,” he said. ”

Next up is the Bank of England, which is expected to cut rates next Thursday and is likely to do so sooner than currently expected.

▌Policy divergence

At the moment, the Fed is in a league of its own. While U.S. central bank policymakers expect interest rate cuts later this year if inflation eases as expected, Federal Reserve Chair Jerome Powell said on Wednesday that there was no reason to rush to the next step.

Speaking to reporters after the Fed’s decision to keep interest rates unchanged, Powell said: “We think both policy and the economy are in very good shape, so we don’t feel like we need to rush into any adjustments.” ”

This is not the result of what Trump said a week ago that he would “demand” from the head of the Fed. Trump appointed the chairman during his first term, but relations have deteriorated due to interest rate policy disagreements, and Powell is expected to be replaced at the end of his current four-year term in May 2026.

In a video address to the World Economic Forum (WEF/Davos) last week, Trump said: “I will demand an immediate rate cut. Again, interest rates should fall around the globe. ”

In fact, only half of the wish could be worse than nothing, and the Fed’s policy divergence with its peers could put upward pressure on the dollar. At a time when Trump wants global trade to “rebalance” in favor of the United States, this will keep imports low. After setting a record U.S. merchandise trade deficit at the end of 2024, this is already a daunting task.

In Europe, global strategists Thierry Wiezman and Gareth Berry of Macquarie Group wrote ahead of the ECB’s policy decision on Thursday: “The policy divergence between the Fed and the ECB is likely to trigger a stronger dollar this week.” Looking ahead, easing pressure on the dollar will require political clarity in Europe, an end to the Russia-Ukraine war, a clear understanding of the nature of US import tariffs and European ‘concessions’, as well as more stable gross domestic product (GDP) growth. ”

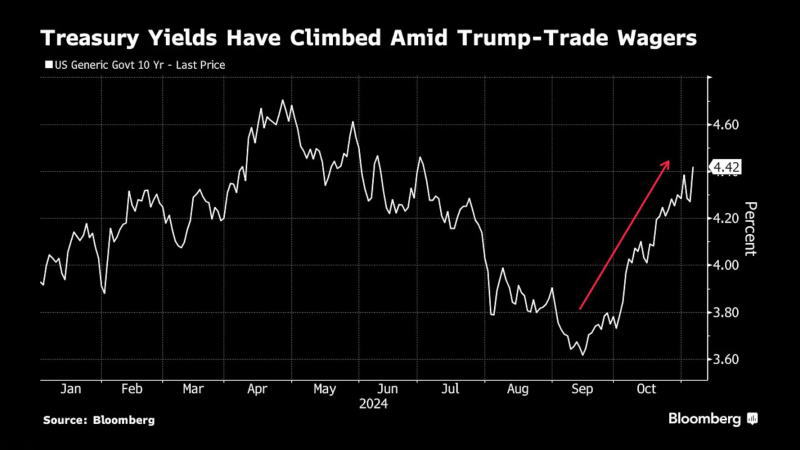

Although the Fed cut interest rates by a total of 1 percentage point last year, the dollar has appreciated about 7% against a basket of global currencies since September.

▌Policy purgatory

The difference in tone between the Fed and its central bank counterparts underscores the different paths the U.S. economy has taken after the global recovery from a deep but short-lived COVID recession in 2020.

High inflation is a global phenomenon given the supply chain disruptions, with central banks unanimously raising interest rates quickly in an attempt to bring inflation under control.

But the root causes of rising prices vary, with events such as Russia’s (RUS) invasion of Ukraine (UKR) in 2022 leading to higher energy price inflation in the eurozone, and more aggressive fiscal spending in the United States causing more demand-driven price increases.

Inflation has also fallen broadly across the globe. But in the United States, the economy has maintained above-trend growth while inflation has fallen, while Europe is on the brink of recession.

The situation leaves Mr. Trump with a potential dilemma: how to improve the economic outcomes of the Biden administration in an economic environment that can arguably be at the limits of full employment, with output and growth rates approaching or exceeding the limits of its potential. U.S. output will grow by 2.8% in 2024, the fourth consecutive year that gross domestic product (GDP) has grown at a rate well above 1.8%, seen as the economy’s long-term potential.

Inflation is almost under control, but the Fed believes there are still enough uncertainties and risks ahead, at least for now.

Diane Swank, chief economist at KPMG, said: “The Fed is really in a kind of policy purgatory. She noted that Powell “frequently used expressions such as ‘wait and see,’ ‘wait and see,’ ‘remain unchanged,’ ‘not rushed,’ and ‘will be patient and watch’ in response to reporters’ questions on Wednesday.”

Mr. Swank said that because the economy is currently being affected by a government that has issued dozens of executive orders and is likely to announce tariffs soon, “the Fed does not know what’s going to happen next.”

December 26. 2024

Survey: Wall Street uses the dot plot as a guide and expects the 2-year US Treasury yield to fall by 50BP next year

Key points:

• Most strategists in a Bloomberg survey believe that the yield on the 2-year Treasury will fall, with the median expectation being 0.5 percentage point lower than the current level in 12 months, to 3.75%.

• “While investors may be myopically focused on the pace and magnitude of rate cuts next year, investors should step back and recognize that the Fed is still in rate-cutting mode through 2025,” Kelly said in the bank’s annual outlook.

• “As the outlook points to a slower pace of rate cuts, the front end of the curve will track that trend,” Manzi said. “Any curve steepening we get will be led by the long end of the curve.”

Wall Street is aligning its rate expectations with the Federal Reserve’s dot plot, which predicts that short-term U.S. Treasury yields will fall in 2025, even though President-elect Donald Trump’s policy mix may make it difficult for bond yields to fall meaningfully, but the impact is more likely to be on long-term Treasury yields.

Most strategists in a Bloomberg survey see a fall in the yield on the two-year Treasury note, with the median forecast being 0.5 percentage point below current levels to 3.75% in 12 months. By contrast, the Fed signaled at this month’s meeting that it would cut rates much less next year than it had expected in September; the dot plot shows that the median Fed official’s expectation is a total of 0.5 percentage point cuts in 2025.

>> “While investors may be myopically focused on the pace and magnitude of rate cuts next year, investors should step back and recognize that the Fed is still in rate-cutting mode in 2025,” David Kelly, a strategist at JPMorgan Asset Management, said in the bank’s annual outlook.

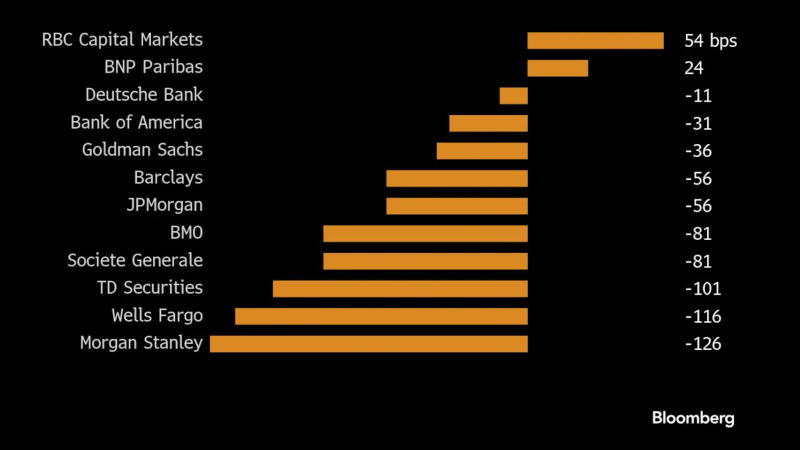

Major institutions predict the level of 2-year Treasury yields at the end of next year _By Bloomberg

>> Tracy Manz, senior investment strategist at Raymond James, said: “As the outlook points to a slowdown in the pace of rate cuts, the front end of the curve will track this trend. Any steepening of the curve we get will be led by the long end of the curve.”

For the long-term 10-year Treasury, strategists believe that the yield will be 4.25% by the end of 2025, about 25 basis points lower than the current level.

>> “No matter how you look at it, whether it’s actual growth, inflation expectations or the term premium, the long term will be under pressure,” said Noel Dickson, a strategist at State Street. “We have been expecting the 10-year Treasury yield to likely rise above 5% in 2025.”

>> “While the Fed is likely to continue to cut policy rates, causing front-end yields to fall, many of the forces driving long-term yields high remain: high neutral rates, increased rate volatility, inflation risk premiums and large net issuance amid price-sensitive demand,” said Anshul Pradhan, a strategist at Barclays. “And Trump’s higher tariffs and tighter immigration controls mean slower growth but higher inflation.”

December 25. 2024

Insufficient liquidity before the holiday, the bond market maintained its decline, and the main yield curve further steepened. Highlights:

• On Tuesday, long-term Treasury yields led the gains, with the 10-year Treasury yield rising to 4.62%, up about 3 basis points, and the gap with the 2-year Treasury yield widened to 28 basis points, close to the highest level since 2022.

• The Federal Reserve (Fed) will end the current easing cycle at a higher level than previously expected, and Trump’s agenda may trigger accelerated growth and inflation, and these prospects have put more pressure on long-term bonds.

• “We expect the 10-year Treasury yield to continue to rise to around 5%, and the 10-year & == & 2-year Treasury yield spread may reach 50 basis points sometime next year,” said DiGaloma.

Benchmark U.S. Treasury yields moved further higher as investors continued to sell long-term bonds in anticipation of long-term highs in interest rates and inflation.

On Tuesday, long-term Treasury yields led gains, with the 10-year yield rising to 4.62%, up about 3 basis points, and the gap with the 2-year yield widened to 28 basis points, close to its highest level since 2022.

The prospect that the Federal Reserve will end the current easing cycle at a higher level than previously expected, and that President-elect Donald Tru-mp’s agenda could trigger faster growth and inflation and could lead to a worsening of the U.S. fiscal situation, puts further pressure on long-term bonds.

>> “We are in a rising yield environment right now, and it’s all coming from long-dated bonds,” said Tom DiGaloma, head of fixed income at Curvature Securities. “There is a lot of concern about what the next administration will do and how it will impact the path of interest rates. There could even be talk of the Fed needing to raise rates in 2025 if inflation rebounds significantly. We expect the 10-year yield should continue to rise to around 5%, and the 10-year & == & 2-year yield spread could reach 50 basis points sometime next year.”

The sharp decline in December narrowed the gains of the US Treasury index this year to nearly zero _By Bloomberg The US Treasury index fell 1.8% this month, narrowing its gains this year to 0.3%, according to Bloomberg data. By comparison, the annual increase of the index as of September 17 was as high as 4.6%. Meanwhile, the demand for the second round of Treasury auctions (Bond Auction) was good. The US Treasury Department (USTD) sold $70 billion of 5-year Treasury bonds on Tuesday, following strong demand for 2-year Treasury bonds auctioned on Monday. On Thursday, the Treasury will sell $44 billion of 7-year Treasury bonds.

And the pricing of overnight index swaps (OIS) shows that traders expect the Federal Reserve to cut interest rates by a total of 33 basis points in 2025, lower than the Fed’s forecast of 50 basis points.

What makes some investors wary of making large trading decisions now is that even though Republicans control the US House of Representatives and Senate, they only maintain a slim majority, so it is unclear how much of Trump’s agenda will actually be implemented.

>> “There are a lot of possible scenarios for next year in terms of what policies are implemented and how they affect the economy,” said Julian Potenza, portfolio manager at Fidelity Investment Management. “There’s a lot of uncertainty. With that in mind, we don’t have any significant active bets on benchmark Treasuries right now.”

December 24. 2024

Long-term US bonds continue to be heavily sold, and the curve steepens further

Highlights:

• U.S. Treasury yields rose on Monday as traders continued to see a slower pace of rate cuts from the Federal Reserve next year and a possible deterioration in fiscal conditions under the policies of U.S. President-elect Donald Trump.

• “Investors are demanding a higher long-term risk premium, and fiscal conditions and increased supply are behind this,” said Brenner, head of fixed income at NatAlliance Securities. “We expect a normalization of the yield curve.”

• “While the dot plot suggests the Fed may slow its pace of easing in 2025, the 2-year to 10-year yield curve has not re-flattened, which could indicate a transition is taking place,” said Ahrens.

U.S. Treasury yields rose on Monday as traders continued to bet on a slower pace of rate cuts from the Federal Reserve next year and a possible worsening fiscal situation from the policies of President-elect Donald Trump.

The rise in long-term Treasury yields outpaced short-term yields, with the former up 6.43 basis points and the latter up 3.20 basis points, leading to a further steepening of the yield curve. The spread between 10-year and 2-year Treasury yields hovered around 25 basis points, and was close to zero at the beginning of this month. At the end of June this year, the spread was -51 basis points, inverted.

The current bond market volatility can be said to still be highly correlated with the dot plot updated by the Federal Open Market Committee (FOMC) last week. The latest interest rate forecasts of the main policymakers of the US central bank show that there will be 2 interest rate cuts next year / a total of 50 basis points, which is 50 basis points lower than the September forecast; while the neutral interest rate was raised by 0.1 percentage point to 3.0%.

At press time, pricing in Overnight Index Swaps (OIS) showed traders expect the FOMC to cut rates by a total of 33 basis points next year, compared with 41 basis points on Friday.

>> “Investors are demanding higher long-term risk premiums, and fiscal conditions and increased supply are behind that, and overall we expect a normalization of the yield curve,” said Andrew Brenner, head of fixed income at NatAlliance Securities.

>> In its latest dot plot, the Fed implicitly outlined a real neutral policy rate 100 basis points below current levels, a key rate it has raised consecutively this year, said Vin Lam, a strategist at Bloomberg Intelligence. While the real neutral rate may not be that high, the 10-year Treasury yield needs to reflect doubts that Fed policy is on autopilot and whether the real neutral rate may be higher than the dot plot estimates.”

>> “While the dot plot suggests that the Fed may slow the pace of easing in 2025, the 2-year to 10-year yield curve has not re-flattened,” said Chris Ahrens, a strategist at Stifel Nicolaus. “This could indicate that a transition is taking place, and fiscal issues and overall policy uncertainty will lead investors to demand a higher long-term premium for long-term Treasuries.”

There was strong demand at a $69 billion auction of 2-year notes on Monday.

According to a Bloomberg survey, the dollar will rise in early 2025 before facing shocks such as accelerating inflation and soaring fiscal deficits.

Entering 2025, 89 respondents were divided on the various risks that could have the biggest impact on the dollar’s gains. Deficit concerns accounted for the largest proportion of responses, at 38%. Another 32% of respondents believed that if Donald Tru-mp, who will take office in January, implements the tariffs he promised during the campaign, the resulting weak growth in the United States (US) and the world will put pressure on the dollar.

The Bloomberg Dollar Spot Index just ended its longest consecutive weekly rise in a year and is now at its highest level since 2022 as traders believe that Trump’s package of policies will eventually push up the dollar.

However, respondents pointed out that while these policies may create conditions for the dollar to appreciate in the short term, their long-term blow to the economy will ultimately curb the currency’s appeal.

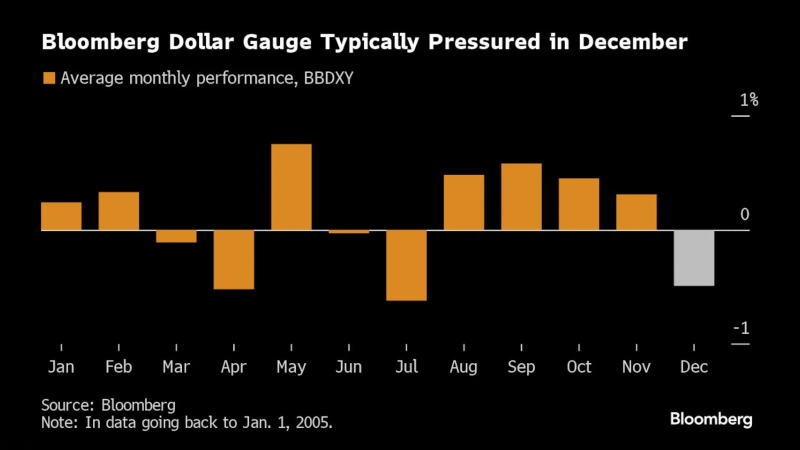

The dollar index typically underperforms in December _By Bloomberg

This was the case during Trump’s first term. The dollar surged nearly 5% from his 2016 election victory to his inauguration the following January as Treasury yields soared. However, the cornerstone asset fell sharply in 2017 as the U.S. economy lost momentum while growth in Europe picked up.

Nevertheless, two and a half times more respondents expected a stronger dollar than bears in the short term. About 70% of respondents believed that Bloomberg’s dollar index would be higher in a month.

Two key themes boosted sentiment in the dollar, even though the dollar index typically underperforms in December.

Respondents and investors expect U.S. Treasury yields to be supported by the Federal Reserve’s gradual rate cuts, which will promote investors to buy dollars to hold U.S. assets. They also mentioned that the large amount of uncertainty surrounding Trump’s future economic policies may lead to rising safe-haven demand, which will drive some investors to buy dollars.

>> “We like the dollar and the core factors supporting the dollar’s rise remain intact,” said Peter Vassallo, portfolio manager at BNP Asset Management. “We added to our long dollar cash and options after the U.S. election.”

The euro fell to its lowest level in two years against the dollar on Friday, weighed down by expectations that the European Central Bank will aggressively ease monetary policy to boost growth in the region. This is in stark contrast to the United States, where the Federal Reserve is expected to cautiously push for rate cuts in the face of resilient economic data.

Key points:

• “U.S. debt sustainability was the top risk cited by respondents to this survey, followed by escalating tensions in the Middle East and policy uncertainty,” the Federal Reserve said in its semi-annual Financial Stability Report (FSR).

• The banking sector generally remains “sound and resilient,” the Fed said, with capital ratios hovering near record levels and liquidity high. But in financial markets, the Fed found that valuations remain high and liquidity “generally low.”

• The new report comes shortly after the 2024 US Presidential Election, which has already had a major impact on US financial markets as investors expect the new administration to reduce regulation.

The excessive debt burden of the US (US) government could lead to fiscal unsustainability, which is now seen by its monetary authorities as the biggest risk to financial stability.

In its semi-annual Financial Stability Report (FSR), the Federal Reserve (Fed) said: “U.S. debt sustainability is the top risk identified by respondents in this survey, followed by the tense situation in the Middle East and policy uncertainty.” ”

The report, a survey of financial market contacts conducted by New York Fed staff from the end of August to the end of October, includes the central bank’s assessment of development risks in four main areas, including asset valuation, corporate and household borrowing, financial sector leverage and financing risk.

More than half of the respondents (54 percent) see national debt sustainability as a prominent risk, up from 40 percent six months ago. The survey found that if there is a recession, more debt issuance by the Treasury Department (USTD) could start to crowd out private investment or limit policy responses.

The Fed said the banking sector remained “robust and resilient” overall, with capital ratios hovering around record levels and high liquidity. But in financial markets, the Fed found valuations still high, liquidity “generally low” and hedge funds at or near all-time highs. In particular, the central bank noted a steady decline in the liquidity of life insurance companies amid the increased use of alternative investments.

On the household side, the Fed said credit card and auto loan delinquencies are above average, especially among households with lower credit scores. Overall, they consider vulnerabilities related to household and corporate debt to be “modest”. “These borrowers represent a relatively small percentage of total debt, and their high delinquency rates are reported to partly reflect the increased borrowing of some households during and after the pandemic, rather than a sudden and general weakening of household repayment capacity,” the report said. ”

The central bank said funding risks had eased but remained “noteworthy”. The report noted that stablecoin assets have “grown substantially” since the last report, with a total market capitalization of more than $170 billion as of early November, just below the all-time high set in April 2022. “These digital assets are structurally vulnerable to runs and lack a comprehensive federal prudential regulatory framework,” the report said. ”

The new report was released shortly after the 2024 US Presidential Election, which has already had a significant impact on U.S. financial markets, as investors expect the new administration to reduce regulation and potentially increase the deficit.

With the support of President-elect Donald Trump, Bitcoin soared to nearly $100,000. The S&P 500 and tech-heavy Nasdaq 100 have been breaking records, while U.S. Treasuries have been falling as economic fundamentals remain strong prompting investors to downgrade their expectations for a sharp rate cut by the Federal Reserve.

U.S. dollar index

As the rally slows, the US dollar will enter a choppy water

Some key market indicators suggest the dollar’s gains may be stabilizing as bullish sentiment sparked by the US presidential election fades.

The world’s reserve currency has been rising since late September, partly due to US President-elect Donald Trump’s plans to raise tariffs and concerns that his other agenda will stoke inflation and prevent the Federal Reserve from cutting interest rates.

The dollar index fell for a third straight day on Tuesday after rising to a two-year high last week. Momentum indicators suggest further gains may be limited in the short term. Traders said investors’ bets have become less one-sided and views on the direction of currencies have become more cautious.

Speculators continue to be long the dollar after the U.S. election results, holding about $17.7 billion in long positions _By Bloomberg

>> Anthony Foster, head of spot trading at Nomura International, said: “The dollar’s super-strong performance after the U.S. election has definitely come to an end, and it’s going to be a rough water next. Sentiment on the euro is very mixed here, with some talking about parity and below parity, and others thinking that the euro can be bought at a bottom. We have seen a number of accounts that have taken profits on euro shorts, but by no means all of them. And investors’ new openings on the yen are largely two-way.”

>> Garfield Reynolds, strategist at Bloomberg Intelligence, said: “From the perspective of relative yield dynamics, the dollar has rebounded too much after the election and will find it difficult to recover to its recent peak level in the short term.”

>> “Over the past week, there has been a net sell-off of the dollar overall globally,” said Riraj Asafle, head of Asia sales trading at JPMorgan. “Asset managers bought the dollar slightly against the euro and sterling, but this was offset by macro funds selling the dollar against the euro.”

Of course, many on Wall Street still expect the dollar to rise further. Hedge funds, asset managers and other speculators have been increasing their long positions in the dollar. They hold about $17.7 billion in bullish contracts, according to the latest data from the Commodity Futures Trading Commission as of Nov. 12.

Goldman Sachs Group Inc. strategists this month abandoned their long-held view of a weaker dollar, now believing the dollar will remain strong “for longer”; they say Trump’s protectionist policies could reignite inflation and cause the Federal Reserve to slow its pace of rate cuts, which would push the dollar’s trade-weighted index up about 3% next year. Morgan Stanley, on the other hand, sees the dollar’s range widening through 2025, but in an upward direction.

• After an initial rush into the “Trump trade,” some investors are reducing their positions and starting to question – can Donald Trump’s tariff proposals really be fulfilled?

• The dollar index gave up most of its election-fueled gains at the close on Thursday and traded little changed on Friday. Treasury yields also narrowed their range to a few basis points after two days of volatility.

• These developments suggest that market volatility will increase as investors shift to realistic assessments of how likely Trump’s campaign promises are to be fulfilled, and divergences are beginning to emerge.

• Higher U.S. tariffs on Chinese (CN) goods could weigh on the latter’s economic growth, but also force China to shift its growth engine toward long-awaited domestic consumption, Goldman Sachs Group Inc. economists said.

• Beijing will be forced to step up fiscal support to further boost domestic demand if tariffs increase, analysts led by Chen Xinquan said in a research note on Friday.

• This year’s wave of government stimulus — including a home appliance trade-in program and property relief measures — has already shifted the main source of growth toward the domestic market next year, they said.

Higher tariffs imposed by the United States (US) on Chinese (CN) goods could weigh on the latter’s economic growth, but will also force the world’s second-largest economy to shift its growth engine toward long-awaited domestic consumption, according to Goldman Sachs.

Analysts led by Chen Xinquan said in a research note on Friday that if tariffs increase, Beijing will be forced to step up fiscal support to further boost domestic demand. They said this year’s wave of government stimulus — including home appliance trade-in programs and real estate relief measures — has already shifted the main source of growth to the domestic market next year.

“If Chinese goods face higher US tariffs next year, this will intensify the shift toward domestic consumption,” the researchers wrote.

Analysts and investors increasingly believe that Chinese officials will turn more to consumption only if the trade situation weakens further. Shan Weijian, executive chairman of PAG and a veteran Asian investor, also said that the tough external environment will prompt officials to prioritize increasing consumption to drive economic growth.

Since 2021, China has identified shrinking demand as a key challenge and has repeatedly said it will promote consumption. Many economists, including policy advisers and those in the private sector, have proposed handing cash to households to boost spending over the past few years, but so far there has been no sign that Beijing will take that advice.

Organizations including the International Monetary Fund have also called on China to rebalance its economy away from heavy reliance on investment and trade. The United States has also joined the ranks, criticizing China’s economy for oversupply. For Beijing, growing U.S. hostility and measures to restrict China in key technologies will only strengthen the government’s priority of strengthening technological self-reliance and manufacturing.

U.S. voters will go to the polls on Tuesday to choose between Donald Trump and Kamala Harris for a new inflation. The former president said he might raise tariffs on all Chinese goods to more than 60% if elected.

Goldman Sachs economists believe that if Trump is elected president, he will impose a 20% tariff on Chinese goods, reducing the Asian country’s GDP by 0.7 percentage points and hitting capital formation and exports. In this context, they also expect China to tolerate a weaker yuan to soften the blow, expand programs to replace household goods and corporate equipment, and provide targeted cash assistance to some households.

Preparing for the Election Day Shock: The U.S. Stock and Bond Exchange Market Has Entered a “Fighting State”!

Source: Finance Associated Press

Four major rights and benefits packages, which will be given when you open an account

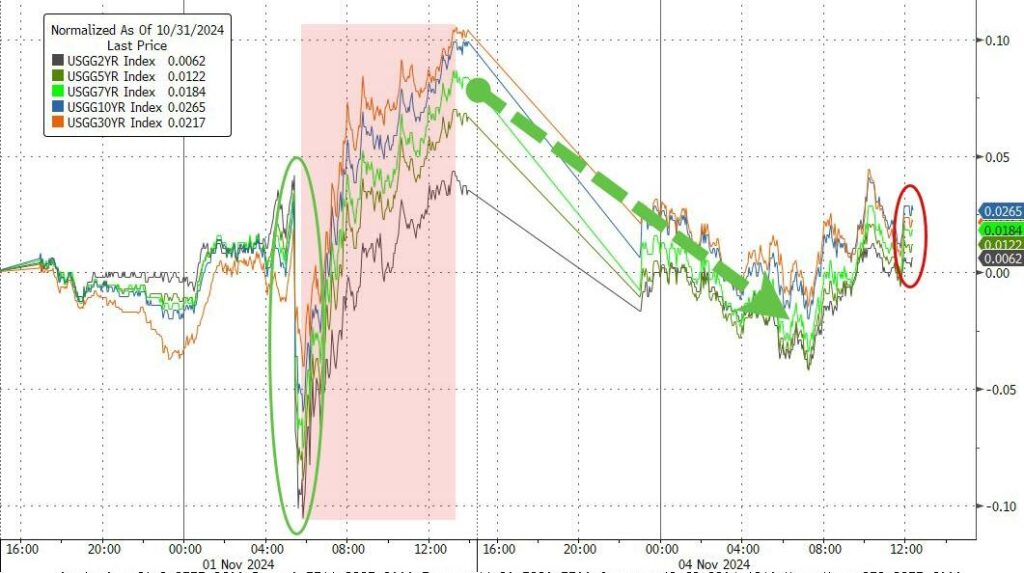

As polls continue to point to a fierce contest in the U.S. presidential election, U.S. stocks, the U.S. dollar and Treasury yields retreated on the first trading day of the election and the Fed’s “super week.” At the same time, traders across the asset sector are in the final pre-election mode……

In the run-up to Tuesday’s vote, traders in different markets appear to be deciding to stay on the sidelines as a series of polls show that the gap between Republican presidential candidate Donald Trump and Democratic presidential candidate Kamala Harris remains small. The results of the vote could be controversial and could even end up delaying the counting of votes for weeks or even months. For many, this means one thing – market volatility is bound to climb.

Another factor that has prevented traders from making higher risk bets at the start of the week is that there are a host of other market-moving news catalysts this week in addition to the election – after Election Day, there will be a Fed decision and Powell’s press conference soon after Election Day, where he will detail the Fed’s future interest rate path. And a large number of U.S. companies will still report three quarterly results.

Chris Larkin, a strategist at Morgan Stanley’s trading platform E*Trade, said, “Normally, the Fed’s interest rate statement tends to dominate the interest rate week, but this week is not an ordinary week.” Traders and investors who have been waiting for the election results must be prepared for a possible delay in the release of the election results and the potential implications of this. ”

Judging from Monday’s market performance, the three major U.S. stock indexes collectively closed down while most investors remained on the sidelines. At the close, the S&P 500 fell 0.28% to 5,712.69, the Nasdaq fell 0.33% to 18,179.98 and the Dow Jones Industrial Average fell 0.61% to 41,794.6.

At the same time, the dollar and Treasury yields both fell as Trump’s win rate fell sharply in the betting prediction market. By the end of the New York session, the ICE U.S. Dollar Index was down 0.05% at 103.89. The yield on the 10-year Treasury note tumbled 8.6 basis points to 4.29%, its biggest one-day drop in two months.

From stocks to Treasuries to foreign exchange and even cryptocurrencies, market anxiety has rarely been so evident in this cycle. A cross-asset risk index compiled by Bank of America has now jumped to its highest point in the week before any election since the financial crisis.

Carol Schleif, chief investment officer of the family office of Bank of Montreal, said, “Investor sentiment may turn bad in the short term, especially if there is uncertainty about the outcome of the presidential election or the announcement of the winner takes longer than expected. Of course, the election results will be finalized sooner or later, and any volatility resulting from this will be an opportunity in our view.”

It is worth mentioning that from the recent changes in the options market, more and more options traders in the cross-asset field have now reduced their risk exposure and increased their hedging efforts to prepare for more volatility.

Stock market

Because short-term options are easier to hedge when the event is about to happen, most of the hedging for the election comes at the last minute. At present, even though the S&P 500 has not fallen by more than 1% for 29 consecutive trading days, the implied volatility of US stocks is much higher than the actual volatility level, indicating that investors are preparing for greater volatility in the future.

Daniel Kirsch, head of options at Piper+Sandler++Co., said, “We continue to see trading interest around the election. Clients who expect Trump to win the election are increasing their holdings of financial stocks and crypto stocks, and those betting on Harris’s victory have bought renewable energy stock options. Hedging has also picked up, with traders buying put options on S&P 500 and Nasdaq ETFs.”

Short-term implied volatility on the S&P 500 has been high relative to one-month levels as the impact of the election and the Federal Reserve permeates the calculation of short-term indicators. The Cboe+VVIX index, which measures VIX volatility, has also risen recently.

For Dan Wantrobski of financial advisory firm Janney + Montgomery + Scott, this week could be a historic one, and before that, the U.S. stock market remains largely in a consolidation state. He noted that investors should expect “more volatility in the next few trading days.” Wantrobski said, “Depending on how things develop, the market itself is either ready to set new highs (the main trend remains bullish) or ready for a larger decline (overbought conditions remain and some recent support levels will be broken).” Once the election is over, market liquidity is expected to support a year-end rebound as hedges will be unwound, mutual funds may start buying in November, companies will resume buying back stocks, and lower volatility will also attract option traders to systematically buy and re-hedge. “Right now, option volatility skews are steep, with the VIX well above realized volatility,” said Zhiwei Ren, portfolio manager at Penn+Mutual+Asset+Management. “Assuming a smooth post-election period, we think these hedges could unwind and we could see a sharp drop in the VIX and a flatter skew. If both of these happen, it could force more buyers into the market, pushing the market higher.”

Foreign exchange markets

The implied volatility of short-term currency options, which price election risk in the foreign exchange market, has also jumped recently in anticipation of greater volatility after the U.S. election.

The Mexican peso’s weekly volatility has climbed to its highest in more than four years, and the premium to expected volatility has widened to 1.3% since the industry began compiling data in 2007.

Investment strategies that may work well in the OTC market (over-the-counter market):

In-depth fundamental analysis

Business Financial Position Assessment: A careful study of the financial statements of the target OTC business, including the balance sheet, income statement, and cash flow statement. Focus on key metrics such as revenue growth trends, profit margins, asset quality, and debt levels. For example, if an OTC company is small but has sustained and stable revenue growth over the years, maintains a reasonable profit margin, and has a relatively healthy asset-liability structure and does not have excessive short-term debt repayment pressure, it may be a potential investment target.

Business Model & Competitiveness Analysis: Understand the core business model of an enterprise and determine whether it is unique and sustainable. For example, an OTC company engaged in the R&D of emerging technologies such as biotechnology may gain market recognition in the future if it has an exclusive patented technology or R&D pipeline and the technology has great application prospects in the industry, thereby bringing returns to investors. It is also necessary to examine its advantages over competitors in the same industry, such as cost advantage, brand advantage or market share advantage.

Keep an eye on industry trends

Emerging industry opportunity capture: The OTC market often has a lot of companies in emerging industries. Pay close attention to the development trends of cutting-edge industries such as new energy, artificial intelligence, and biomedicine. For example, in the early days of the rise of the new energy vehicle industry, some related OTC parts suppliers seized the opportunity of the rapid development of the industry and provided key components for OEMs.

Industry cycle grasp: For some OTC companies in traditional industries, it is necessary to understand the cyclical characteristics of the industry. For example, when the metal price is in an upward cycle, the profitability of the mining OTC company usually improves significantly, and if it can be deployed in advance and sold at the right time, it can achieve profitability. Investors need to comprehensively judge the stage of the industry cycle based on industry research reports, macroeconomic data, etc.

Diversification

Multi-company fragmentation: Due to the uneven quality of companies in the OTC market, the risk for a single company is relatively high. By investing in multiple different OTC stocks, you can diversify the risks caused by poor management of a particular company, sudden negative events, etc. For example, if you allocate capital to OTC companies of different sizes in different industries, even if a few of them fail, other companies that are performing well may still generate returns for the portfolio.

Combining different risk levels: In addition to pure OTC stock investment, it can also be combined with some fixed income products in the OTC market (such as some OTC bonds, etc.) for allocation. Fixed income products are relatively low risk, which can balance the risk of the entire OTC portfolio to a certain extent, especially when the stock market is volatile, and play a role in stabilizing the value of the portfolio.

Focus on special events and catalysts

M&A and restructuring expectations: Pay attention to whether OTC companies have potential M&A and restructuring opportunities. Some large enterprises may acquire small enterprises with unique technologies or businesses in the OTC market to improve the layout of the industrial chain. If this kind of information is captured in advance and the investment is made, the stock price of the acquired company will often rise sharply when the merger and restructuring actually occurs. For example, after a well-known pharmaceutical company announced the acquisition of a small biopharmaceutical R&D company in the OTC market because it valued a potential new drug it was developing, the OTC company’s stock price soared, and the early investors reaped a lot of money.

Product breakthroughs or major contract signing: For technology OTC companies, if they develop a new product that makes a major breakthrough, such as passing a key clinical trial, obtaining important technology certification, etc., or signing a major commercial contract, it can be a catalyst for stock price growth. Investors should continue to keep track of company announcements and related industry information to catch such events that may drive stock prices up in a timely manner.

Long-term investment perspective

Growing with your business: Many OTC businesses are in the early stages of development and need time to achieve their goals such as business expansion, profitability improvement, and more. Investors who have a long-term investment mindset and accompany the company from start-up to maturity are often likely to reap huge returns. For example, some investors who invested in OTC companies in the e-commerce field in the early stage have enjoyed the benefits of substantial stock price appreciation in the process of the company’s growth from a small regional platform to a well-known national e-commerce platform after years of development.

Ignoring short-term fluctuations: Stock price fluctuations in the OTC market may be more volatile than those in the Main Board market, and are more affected by factors such as individual news and market sentiment. However, if there is no fundamental change in the fundamentals of the company, investors should try to ignore short-term stock price fluctuations, avoid frequent buying and selling due to panic or greed, stick to a long-term investment strategy, and wait for the true reflection of corporate value.

It should be noted that the investment risk in the OTC market is relatively high, and the transparency of corporate information may not be as high as that of the main board market.